SPF and the Inflation Reduction Act of 2022

This is an initial assessment of the energy efficiency incentive programs contained in the IRA. Some programs, such as tax credits and deductions, take effect immediately, while other programs provide funding to federal agencies allocated to states to create these programs managed through state, county, and municipal governments. This document will be updated regularly as more detailed information about these tax credits and incentive programs becomes available. As state-managed programs come online, they should be included in the Database of State Incentives for Renewables and Efficienct (DSIRE) website.

This SPFA summary is provided for informational purposes. SPFA does not have taxation experts on staff and does not guarantee any tax incentive nor predicts your eligibility for any tax incentive. Please consult with your accountant regarding any tax questions.

Building energy efficiency incentives addressed by the IRA are categorized as follows:

Incentives for Existing Residential Buildings

There are three residential retrofit programs to incentivize homeowners to improve the energy efficiency – the Residential Efficiency Tax Credit (25C), the HOMES Act, the DOE Electrification Rebate Program and a HUD program for efficiency improvements for low-income housing.

Residential Efficiency Tax Credit (25C)

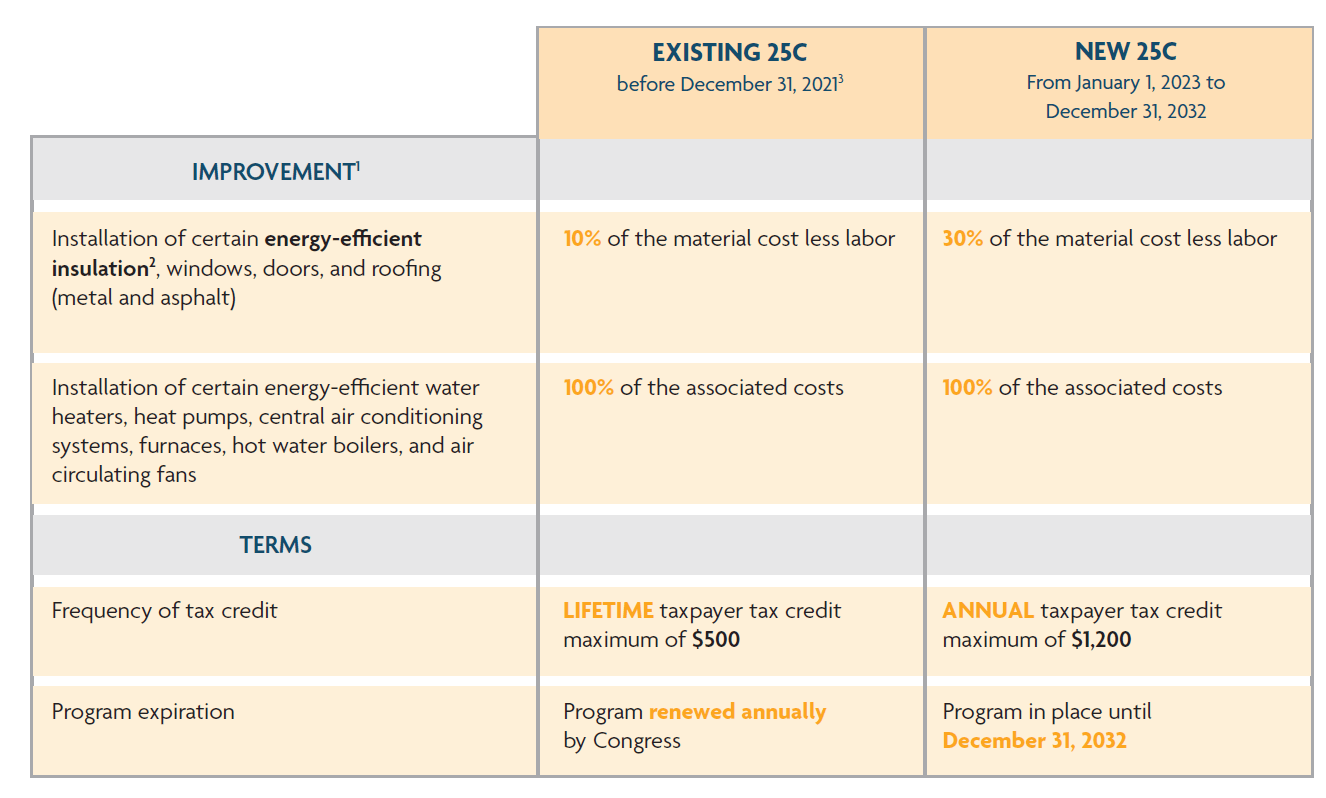

Initially created under the Energy Policy Act of 2005 (EPAct) and added to the federal tax code under Section 25C. the program has been expanded and extended under the IRA (Section 13301). First, the new 25C program retroactively extends the 2021 program through December 31, 2022. More important are the changes beginning January 1, 2023. For improvements completed in 2023, the new terms of 25C allow a 30% tax credit, up to an ANNUAL maximum of $1,200. This is a significant increase over the 10% credit with a $500 lifetime maximum.

A comparison of the existing and enhanced 25C programs are shown in the table below:

Notes:

- Tax credits are subject to individual limitations for specific envelope and equipment improvements. For more detailed information, visit the DoE website

- Energy efficient insulation improvement includes air sealing

- Existing 25C program reinstated until December 31, 2022 under the IRA

The annual limits for specific types of qualifying improvements will also be changed. Beginning in 2023, the annual limits will be:

- $150 for home energy audits;

- $250 for an exterior door ($500 total for all exterior doors);

- $600 for exterior windows and skylights; central air conditioners; electric panels and certain related equipment; natural gas, propane, or oil water heaters; natural gas, propane, or oil furnaces or hot water boilers; and

- $2,000 for electric or natural gas heat pump water heaters, electric or natural gas heat pumps, and biomass stoves and boilers (for this one category, the $1,200 annual limit may be exceeded).

Another major change for the new 25C program is that it will be extended to December 31, 2032. The new program incentivizes homeowners to perform a full range of qualifying energy improvements over multiple years.

HOMES Act

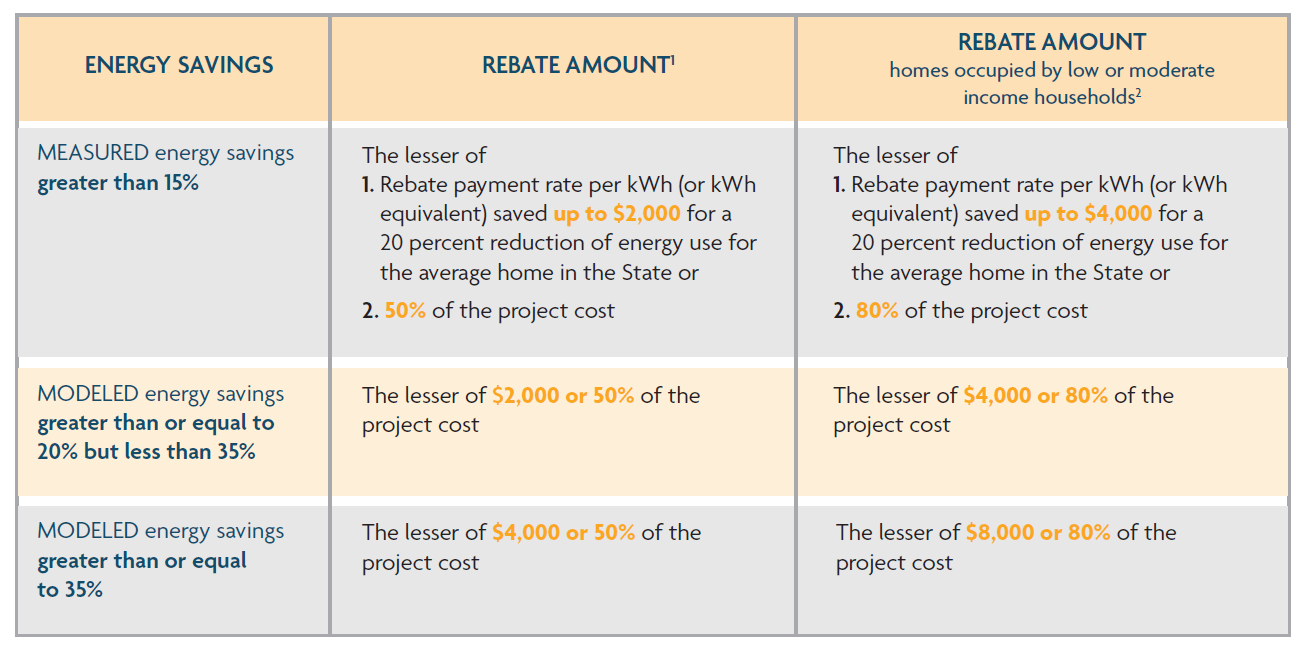

The Home Owner Managing Energy Savings Act of 2019 (HOMES Act) directs the Department of Energy (DOE) to establish the Home Energy Savings Retrofit Rebate Program to provide rebates to reward homeowners for achieving home energy savings.

The IRA (Section 50121) provides $4.3 billion to the DOE to implement the HOMES Act rebate program through state energy offices. The HOMES Act provides rebates based on measured or estimated (modeled) energy savings as determined by an energy audit using DOE-approved software. The rebates available to both individual homeowners and aggregators for single family and multifamily properties and may not be combined with other federal grants or rebates. However, the HOMES rebate can be combined with homeowner tax credits under 25C.

The rebates are based on energy savings as follows:

Notes:

- Multifamily rebates are capped at $200,000 per multifamily building for units that model energy savings of 20-35% and $400,000 for buildings that model savings of more than 35%

- For multifamily properties, not less than 50% of the dwelling units must be occupied by low- or moderate-income households.

DOE Electrification Rebate Program

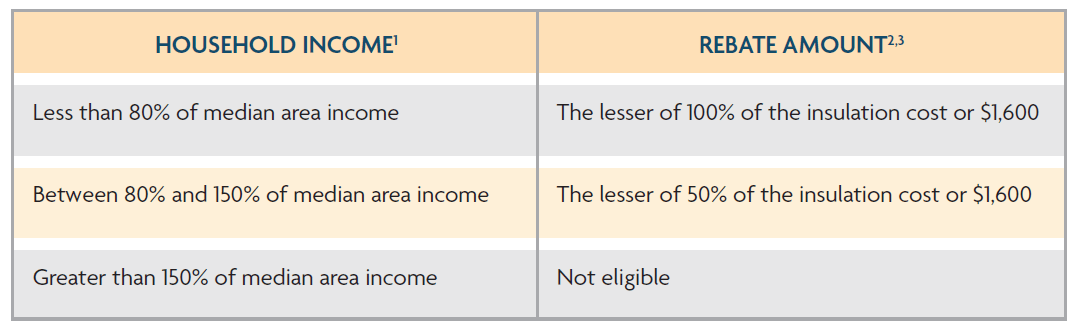

The IRA (Section 50122) provides $4.5 billion to the DOE to support state-level rebate programs for home electrification upgrades that include certain provisions for insulation and air sealing. The objective of this program is to reduce the use of fossil fuels for residential heating and cooking and transition these to electric power. The electrification rebate is applicable for single family and multifamily properties and may not be combined with other federal grants or rebates. However, the electrification rebate can be combined with homeowner tax credits under 25C.

The maximum rebate for insulation, air sealing and ventilation is $1,600 subject to household income requirements as follows:

Notes:

- For multifamily units 50% of the residents meet the income requirements

- A cap on multiple rebates is limited to $14,000 to an eligible entity

- Government, commercial or non-profit entities that receive the rebate and install insulation in a qualifying low-income home may receive an additional $500 for installation

HUD Affordable Housing Upgrades

The IRA (Section 30002) has allocated $4.0 billion to the Department of Housing and Urban Development (HUD) to fund loans that improve low-income housing. The program will extend until September 2028. These loans, grants and loans converted to grants can be awarded to property owners that agree to an extended period of affordability for the property.

These improvements to eligible properties include:

- improve energy or water efficiency

- enhance indoor air quality or sustainability

- implement the use of zero-emission electricity generation

- use of low emission building materials or processes,

- energy storage or building electrification strategies

- address climate resilience

Incentives for New Residential Buildings

Within the IRA there are increased incentives for builders and developers of new homes. An extensions, increases and modifications are included for the New Energy Efficient Home Credit.

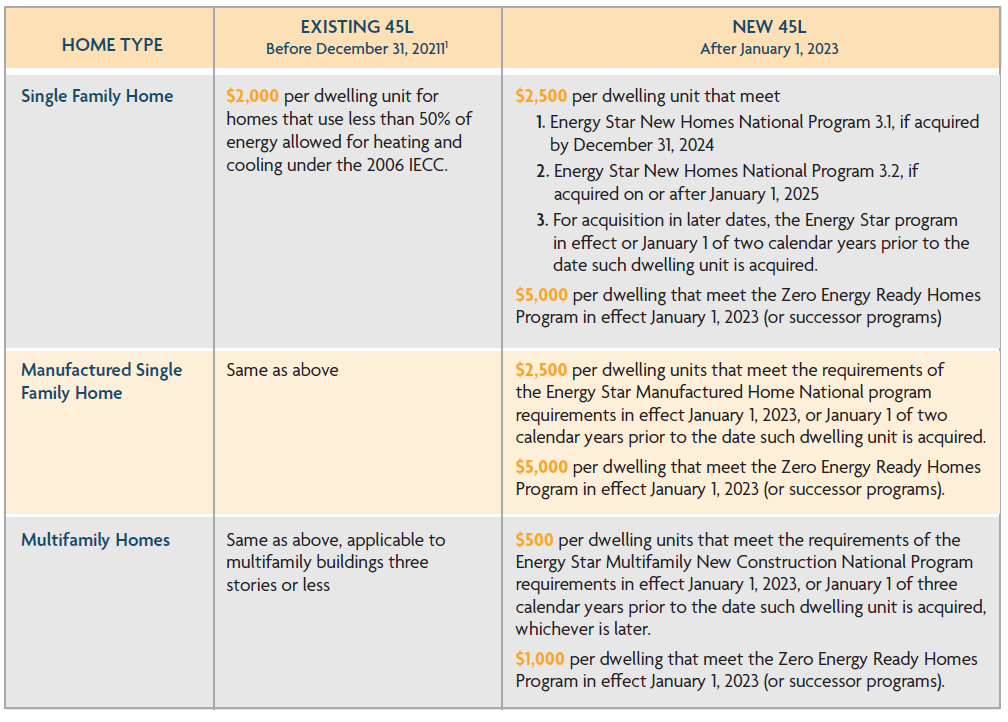

New Energy Efficient Home Tax Credit (45L)

Initially developed under the EPAct of 2005, the 45L program has provided tax credits to builders and developers of new energy-efficient single and multifamily homes. During its 15-year life, it has provided a $2,000 tax credit for each dwelling unit with heating and cooling energy consumption less than 50% of that required by the 2006 IECC. This program expired on December 31, 2021.

The IRA (Section 13304) extends the current program until December 31, 2022. Beginning January 1, 2023 through December 31, 2032, a tax credit of $2,500 is provided to buildings that meet the new EnergyStar programs. An increased credit of $5,000 is provided for each home meeting the requirements of DOE’s Zero Energy Ready Home program. Note that the program phases in changes to the EnergyStar and Zero Energy Ready Homes programs. More importantly, there are prevailing wage requirements for all labors and mechanics employed by the eligible entity, their contractors, and their subcontractors.

Notes:

- Current 45L program extended to December 31, 2022 under the IRA.

Incentives for New and Existing Commercial Buildings

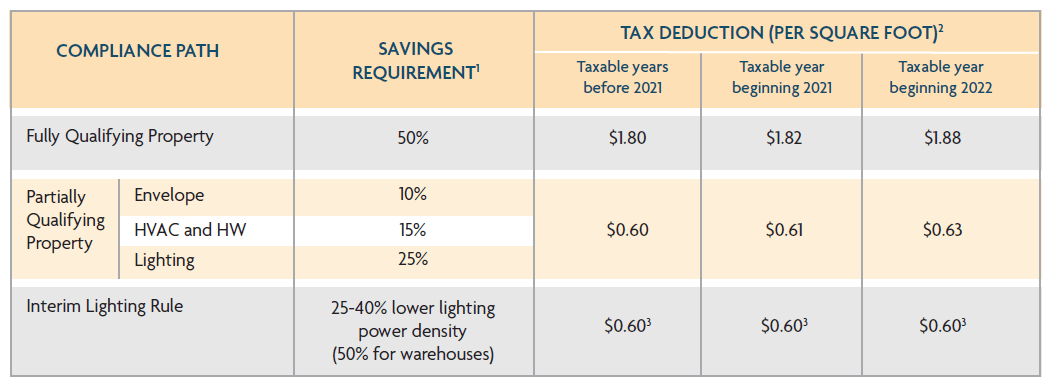

Created under EPAct with a goal of reducing energy consumption in buildings across the U.S., the 179D tax deduction can be claimed by owners of commercial and large multifamily residential buildings that install qualifying energy efficiency measures that include lighting, HVAC, and envelope improvements. For government and non-profit entities that own buildings, this deduction may be allocated to architects, engineers, or contractors that design or install the qualifying improvements. Eligible projects must be certified by a qualified third-party using DOE approved software to demonstrate a 50% energy reduction per ASHRAE 90.1. Prior to the IRA, the 179D permanent deduction was a maximum of $1.88 per square foot for improvements that demonstrate an energy reduction of 50% or more per ASHRAE 90.1 – 2007.

Details regarding specific improvements are shown in the table below developed by DOE.

Notes:

- Savings refer to the reduction in the energy and power costs of the combined energy for the interior lighting, HVAC, and hot water systems as compared to a reference building that meets the minimum requirements of ASHRAE Standard 90.1-2007 for properties placed in service on or before December 31, 2020. Savings percentages based on IRS Notice 2012-26.

- Not to exceed cost of qualifying property

- The tax deduction is prorated depending on the reduction in Lighting Power Density (LPD). See IRS Notice 2006-52 for the definition of "applicable percentage."

Section 13303 of the IRA makes significant changes for new property placed in service after December 31, 2022. The new incentive ranges from $0.50 to $1.00 per square foot depending on the percentage improvements over ASHRAE 90.1 -2019. For improvements of 25%, the deduction is $0.50 per square foot. The deduction increases $0.02 per square foot, up to a maximum of $1.00 per square foot when 50% improvements are achieved.

It should be noted that the ASHRAE 90.1-2019 energy code is significantly more stringent than past editions. The changes to 179D beginning in 2023 lower the savings threshold from 50% to 25% but have no provisions for partial improvements. Qualified retrofits must be for buildings that are at least 5 years old and must achieve efficiency improvements of at least 25%

It is also important to note that deduction increase five-fold to $2.50 to $5.00 per square foot for improvements by laborers and mechanics employed by the taxpayer or any contractor or subcontractor in the installation of any improvement.

Incentives for Energy Codes Adoption and Workforce Training

Lastly, under the IRA, there is funding support adoption of current energy codes by states and local jurisdictions. There are also programs to train workers for installation and evaluation of various energy improvements.

State Energy Code Adoption

IRA (Section 50131) has allocated $370 million in funding to the DOE to assist state and local governments to adopt and enforce the latest version of the current energy codes. For residential buildings, a code that meets or exceeds the 2021 International Energy Conservation Code (or provides equivalent or better energy savings) is acceptable. For commercial buildings, any code that meets or exceeds the requirements of ANSI/ASHRAE/IES Standard 90.1–2019 (or provides equivalent or better energy savings) is acceptable. An additional $670 million has been allocated to the DOE for states and local governments zero energy or ‘stretch’ provisions of these energy codes.

State-Based Home Energy Efficiency Contractor Training Grants

The IRA (Section 50123) has allocated $200 million through 2031 to the DOE to provide grants for state programs that train and educate contractors involved in the installation of home energy efficiency and electrification improvements, including eligible improvements under the previously mentioned HOMES Act and Electrification programs. These funds, to be administered by the states, may be used to reduce the cost of training contractor employees and/or provide testing and certification of contractors trained and educated under such programs. More information will be provided as these state programs are developed.